Each CDR is equivalent to owning a variable number of the underlying shares. This number is called the CDR ratio. The CDR ratio is adjusted daily to provide a notional currency hedge. As the CDR ratio increases or decreases, the number of underlying shares represented by one CDR increases or decreases. So, if the Canadian Dollar strengthens, each CDR will represent a larger number of underlying shares. Conversely, if the Canadian Dollar weakens, each CDR will represent a smaller number of underlying shares.

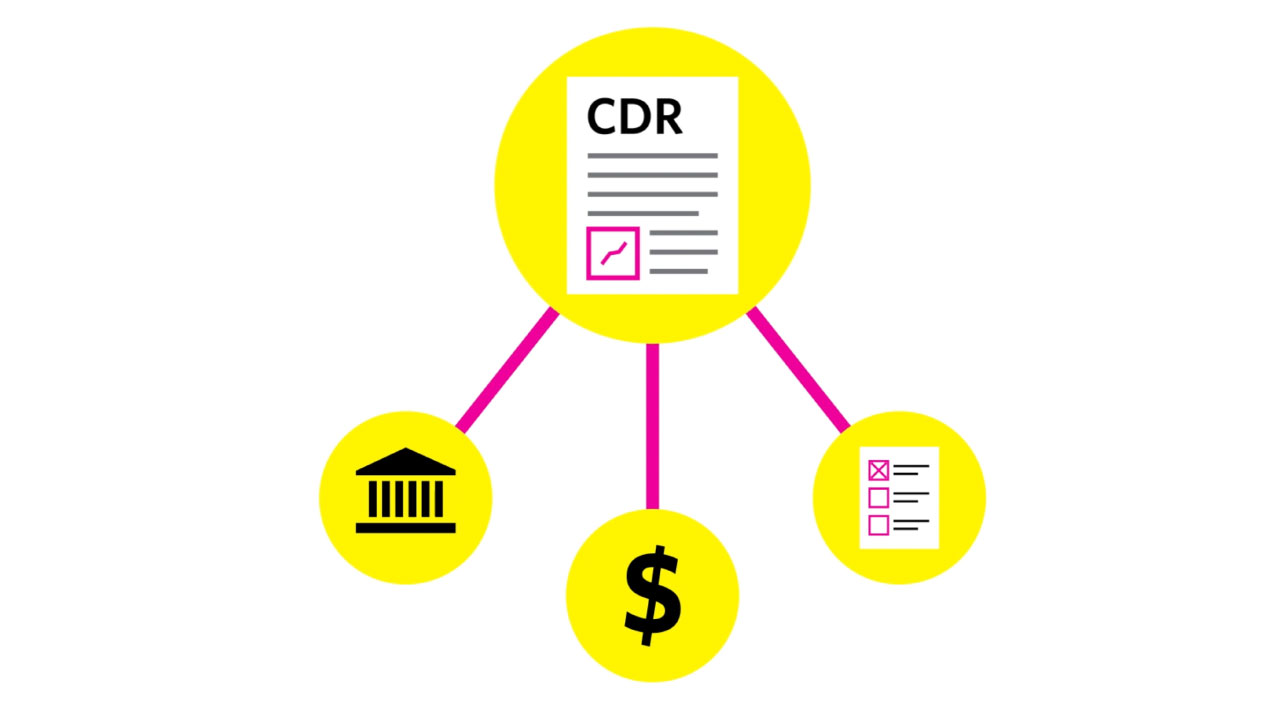

Canadian Depositary Receipts (CDRTM)

Depositary receipts are a time-tested way for investors to access shares of foreign listed companies. Canadian Depositary Receipts (CDRs) are designed to make it easier for Canadians to access the most popular publicly listed US companies, in Canadian Dollars, and with a built-in currency hedge. CDRs are now listed and trading on the NEO Exchange, operating as Cboe Canada, alongside some of your favourite public companies and ETFs.

A Canadian-First Approach to Cross-Border Investing

CDRs finally make it easy for Canadian investors, financial advisors, and institutions to invest in some of the world's largest companies, with a few big improvements:

- CDRs relating to some of the largest US companies listed on NYSE and NASDAQ are now trading in Canadian Dollars.

- Flexibility of investment through fractional ownership of US stocks.

- Your exposure to US Dollar currency risk is minimized through built-in currency hedging, allowing you to own the company, not the currency.

Stay in the Know

Stay up to date about current listings and be the first to know about upcoming CDR launches on the NEO Exchange, now operating as Cboe Canada.

Subscribe Now Download Brochure

Cboe Canada Listed CDRs

{{ md.timeService.currentDateTime | date: 'longDate' }} |

{{ md.timeService.currentDateTime | date: "HH:mm:ss" }}

| Symbol | Name | Previous Close | Last Price | Change % | Trades | Volume |

|---|---|---|---|---|---|---|

| {{ item.symbol }} | {{ item.symbolFullName }} | {{ (item.prevClosePrice | number: 2) || '-' }} | {{ (item.lastSalePrice | number: 2) || '-' }} | {{ item.priceChangePercentage | number: 2 }} | {{ (item.numberOfTrades | number: 0) || '-' }} | {{ (item.volume | number: 0) || '-' }} |

Available in Canadian Dollars, Listed on Cboe Canada

Buying shares of companies listed on exchanges outside of Canada can come with an extra hurdle and additional fees to convert cash to a foreign currency. Not anymore! CDRs make some of your favourite US stocks available in Canadian Dollars.

Don’t see a company you want to buy as a CDR yet? Click here and we will let our CDR issuers know what companies you’re interested in buying.

Fractional Ownership: Making US Stocks More Accessible

For a Canadian investor to buy one single share in 5 of the most popular companies listed on major US exchanges, you would need more than $1,600 Canadian Dollars at today’s rates* – this doesn’t include additional fees and service charges:

- Alphabet Inc. ($146 USD / share)

- Amazon.com ($155 USD / share)

- Apple ($194 USD / share)

- Netflix ($490 USD / share)

- Tesla ($211 USD / share)

*Share prices and exchange rate as at January 25, 2024, referencing the Bank of Canada US Dollar Exchange Rate

CDRs make it possible for Canadians to obtain fractional share investments in US listed companies. Instead of paying $700 USD for one Costco share, you can now buy a CDR giving you fractional ownership of a share for as little as $30 Canadian Dollars.

Own the Company, Not the CurrencyTM

Investing directly in US companies listed on exchanges outside of Canada can be expensive and expose the investor to currency fluctuations. CDRs come with a built-in currency hedge of US Dollar exposure so you don’t have to worry about exchange rate fluctuations between Canadian and US Dollars.

This means your return is dependent on the performance of the company – not the currency – mitigating an additional risk associated with cross-border investing.

The Longest Undefended Border Just Got a Hedge

Purchase CDRs

Investors can trade CDRs through their usual investment channels, including discount brokerage platforms and full-service dealers. You can purchase CDRs today via any of these online retail brokerages, or through your financial advisor.

Purchase CDRs at any of these online retail brokerages

Learn more about CDRs

NEO Spotlight | A Deeper Dive into CDRs

CDRs - Own the Company,

Not the Currency™

CDRs - Comparing Apples to Apples

CDR Issuer

Frequently Asked Questions

Stay in the Know

Stay up to date about current listings and be the first to know about upcoming CDR launches on the NEO Exchange, now operating as Cboe Canada.

Subscribe Now Download Brochure

Questions? Contact us to learn more.

×